2021 Healthcare Prognosis

For our fifth annual survey, we once again tapped our network of pundits to weigh in on the healthcare industry’s news, trends and challenges. With the global pandemic, 2020’s survey results offered insights into the sentiment elicited by Covid-19, as well as predictions and questions about its impact on the presidential election, return to work and vaccines. It was the first year we conducted multiple surveys, and dramatic changes in opinion were captured as the country locked down and we slowly came to understand what we were up against. We were SO, SO wrong about the stock market as it quickly recovered from March lows and soon reached new heights, and less than 50% predicted that an effective vaccine would be available by the end of 2021. But we got more right than wrong as the election did swing to Biden, the GDP dropped more than 2% for 2020, and telemedicine broke-through, emerging as a lasting component of patient care.

This year, respondents weighed in on the impact of Covid-19, vaccine rollouts and passports, how the Biden administration will shape the future of healthcare, and the outlook for health IT startups in 2021 and beyond.

Our commentary on the most interesting findings is presented below, followed by the full results.

I. VACCINATIONS

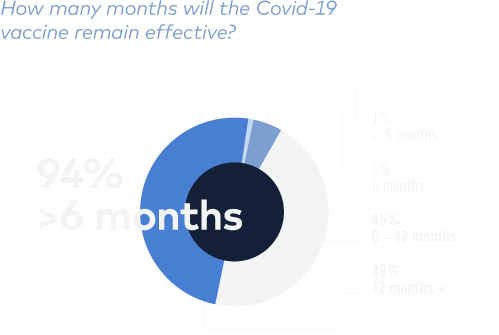

Just over a year into the pandemic, over 300 million vaccine doses have been administered in the U.S. and, as a result, the number of Covid-19 cases has steadily declined. With new variants of Covid-19 detected in various countries, time will tell how the current vaccines hold up against these new variants and if booster shots can be developed quickly enough, before current vaccination protection wanes.

VACCINE CONFIDENCE

Nearly half of our survey respondents believed Covid-19 vaccinations would provide protection for at least 12 months. An overwhelming majority (96%) also answered that a Covid-19 booster or variant shot would be available before current protection wanes. And given the positive results from Pfizer and Moderna so far, the majority (63%) of respondents did not believe that there would be an alternate vaccine that would replace these two as the standard of care in the near future.

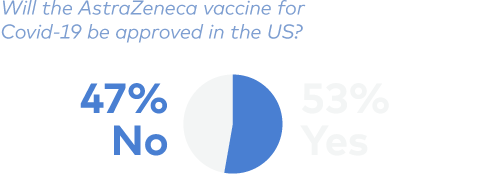

A slim majority of respondents (53%) felt that AstraZeneca’s vaccine would be approved in the U.S. This one will be interesting to track as the survey’s authors would take the under on that bet.

VACCINATING OUR YOUTH

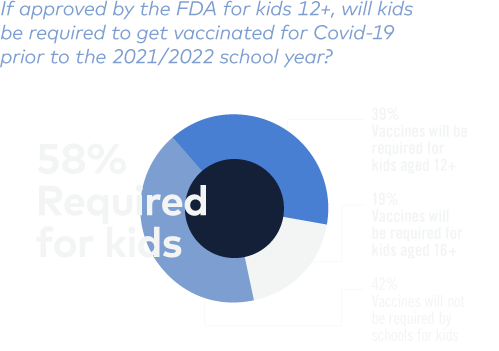

Nearly 60% of survey respondents answered that vaccines will be required for kids to attend school in person. Many uni versities, including the entire University o f California system and Stanford, have m andated vaccinations for all students, fa culty and staff for the fall term. On May 10 , the F.D.A. authorized the use of the Pf izer- BioNTech vaccine for children 12 -15. Moderna also recently announced its Covid-19 vaccine as 100% effective in te ens.

STRONG SUPPORT FOR PASSPORTS

The FDA’s emergency use authorizations specify that each person being vaccinated must give consent, which makes vaccine mandates a gray area for businesses where gettin g consensus, much less imposing things, is uncommon. However, more than half of re spondents agreed that vaccine passports w ould be necessary to reopen and trav el safely, and considered it acceptable for cer tain employment opportunities, such as el dercare. A small number of respondents expressed concerns over possible opportuniti es for injustice or invasion of priva cy (5%).

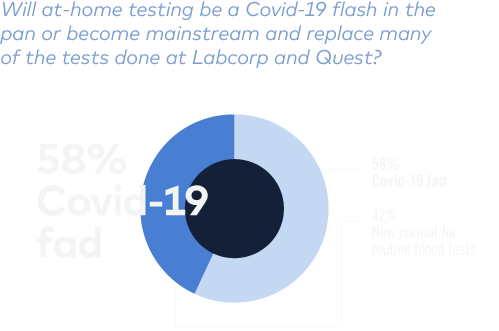

AT-HOME TESTING FIZZLES

Amazon has voted on the side of “New Normal” with their plans to launch a diagnostics business starting with a Covid-19 testing kit. However, the majority of respondents felt that at-home testing is a Covid-19 fad (58%).

II. RETURN TO WORK

Relaxed health guidelines from the CDC signal a return to work is on the horizon. Today, companies are grappling with the best policies and procedures to ensure a smooth and safe transition back to the office.

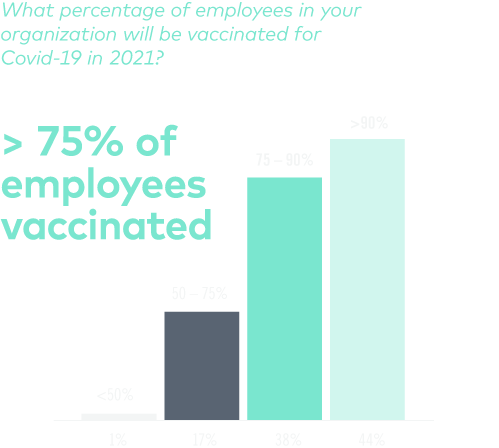

ANTICIPATING HIGH VACCINATION RATE

82% of respondents believe that over 75% of their organization would be v accinated in 2021, which indicates strong c onfidence among business leaders in t he effectiveness and adoption rate of the vacc ines.

III. BIG TECH AND THE FUTURE OF HEALTHCARE

The impact of Covid-19 has drawn increased attention towards improving the healthcare system, with big tech companies such as Apple and Google making big bets on their ability to innovate.

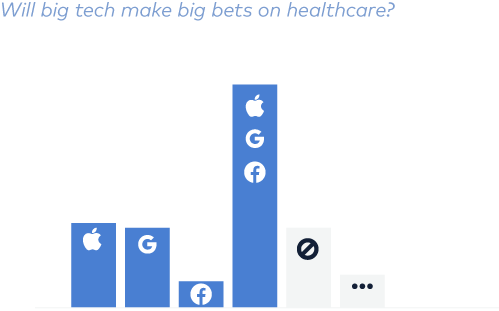

BULLISH ON APPLE AND GOOGLE

Most respondents expect big tech to make big bets in the healthcare space, with Apple and Google favored to take action. There were a few write-ins for Microsof t to be a player, bolstered by their recent acquisition of Nuance. Whether any will be successful, given no one but Amazon has shown any propensity, is another quest ion entirely.

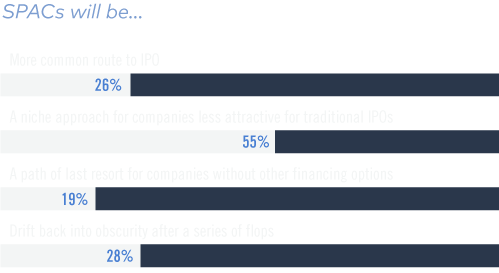

SPACTACULAR OR SPACOCALYPSE?

SPACs boomed in Q1, but most believe that they’ll be, at best, a niche approach moving forward, especially with the SEC watching SPACs more closely, deteriorating economics for sponsors and, most importantly, poor after-market performance by recently SPAC’ed companies.

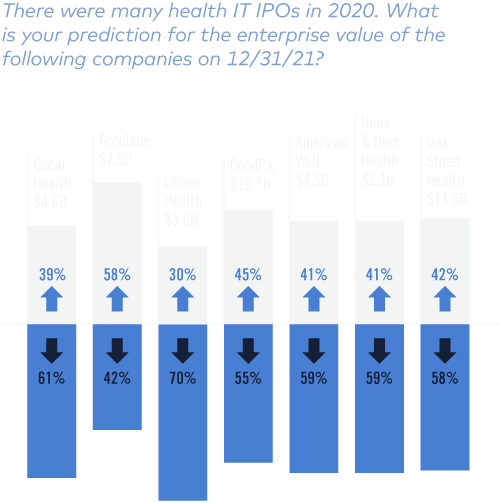

HEALTH OF HEALTH IT IPOS

Perhaps signaling an expected end to the bull run, more than company-specific concerns, respondents predict that the enterprise value for almost all companies on the list would be lower by year end, with Accolade the lone outlier. Clover Health received the most concern as 70% predicted their enterprise value would be lower.

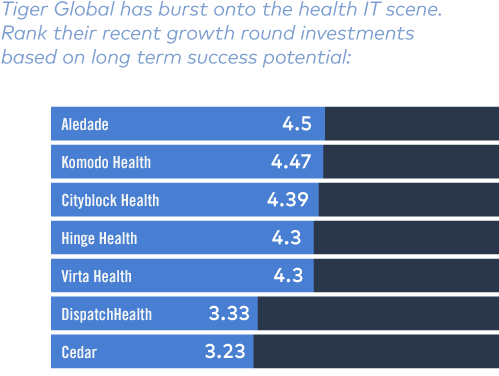

TIGER GLOBAL BETS BIG ON HEALTH IT

Tiger Global roared into health IT in Q4 2020 and continues to be a growth investor of choice as evidenced by the number of Q1 2021 financings. Among its health IT investments, Aledade and Komodo Health received the highest scores from respondents in terms of long-term potential.

Full Survey Results

More than 240 respondents from health IT startups, large employers, insurance companies, healthcare providers, academics, government, investors and professional service providers conducted the survey between April 27, 2021, and May 7, 2021. If you would like to view the results of our previous surveys, you can find them here:

2020 Healthcare Prognosis

2019 Healthcare Prognosis

2018 Healthcare Prognosis

2017 Healthcare Prognosis

1

By EOY 2021, consensus

will say that Covid-19

vaccination provides

protection (both general

durability and efficacy

against variants, known

and unknown) for:

| 1% | <6 months |

| 5% | 6 months |

| 45% | 6-12 months |

| 44% | 12-24 months |

| 3% | >24 months |

2

WWill a useful Covid-19

booster/variant shot be

available before protection

from the current vaccines

wanes?

| 96% | Yes |

| 4% | No |

3

If approved by the FDA

for kids 12+, will kids be

required to get vaccinated

for Covid-19 prior to the

2021/2022 school year?

| 42% | Vaccines will not be required by schools for kids |

| 19% | Vaccines will be required for kids aged 16+ |

| 39% | Vaccines will be required for kids aged 12+ |

| 0% | Vaccines will be required for all kids |

4

Will the AstraZeneca

vaccine for Covid-19 be

approved in the US?

| 53% | Yes |

| 47% | No |

5

Will a non-Pfizer/Moderna

vaccine be standard of care

for Covid-19 in 2022?

| 37% | Yes |

| 63% | No |

6

Will monoclonal antibodies

gain traction?

| 17% | Yes, as frontline therapy for most newly infected people/std> |

| 11% | Yes, as prophylaxis for high-risk patients |

| 58% | Yes, as treatment for high-risk patients |

| 14% | No |

7

How do you feel about

Covid-19 vaccine

passports? (select all that

apply)

| 58% | Necessary to reopen and travel safely |

| 63% | Acceptable for certain employment opportunities (i.e. elder care) |

| 12% | Create too many opportunities for injustice |

| 5% | An invasion of privacy |

| 5% | Other |

8

We will be wearing masks

in public (outdoors or

indoors)...

| 19% | Only until July 4th, when most Americans are vaccinated |

| 20% | The rest of 2021o/td> |

| 34% | For the foreseeable future when in crowded places |

| 27% | For the next 2 years on planes and high risk settings |

9

Will at-home testing be a

Covid-19 flash in the pan or

become mainstream and

replace many of the tests

done at Labcorp and Quest?

| 58% | Covid-19 fad |

| 42% | New normal for routine blood tests |

10

What percentage of

employees in your

organization will be

vaccinated for Covid-19

in 2021?

| 1% | <50% |

| 17% | 50-75% |

| 38% | 75-90% |

| 44% | >90% |

11

As the Covid-19 vaccine

rollouts accelerate, when is

your company thinking

about returning to

full-time, in-person work?

| 11% | We are already back in the office |

| 62% | Planning to be back in-person by fall 2021 |

| 13% | Planning to be back in-person by January 2022 |

| 14% | No current plan to return to the office |

12

What will a return to work

look like for your company?

(select all that apply)

| 42% | Vaccine required unless medically unable |

| 44% | Wearing masks in common areas |

| 53% | New policies around going to the office with any symptoms (not allergies) |

| 82% | Shifting to a hybrid model with some people in the office and others continuing to work from home full/part time |

| 25% | Staggering teams' in-person days at the office to reduce daily headcount |

13

Amazon Care is Amazon’s

latest foray into

healthcare. By 2022, it

will…(select all that apply)

| 45% | Be used only by Amazon employees |

| 40% | Be offered to Amazon Prime members on a fee-for-service basis |

| 18% | Gain traction among large employers and take market share and impact valuations of innovators |

| 18% | Be forgotten |

14

Will big tech make big bets

on healthcare?

| 17% | Yes, Apple will expand beyond the watch |

| 16% | Yes, Google will go beyond offering cloud services and make a big acquisition |

| 2% | Yes, Facebook will build healthcare-oriented apps and launch VR-assisted therapies on Oculuso/td> |

| 44% | Yes, all of the above |

| 16% | No, none of the above |

| 5% | Other |

15

SPACs will… (select all that apply)

| 26% | Become a more common way for companies to go public long term |

| 55% | Be a niche approach for companies that are less attractive for traditional IPOs |

| 19% | Be the path of last resort for companies without other financing options |

| 28% | Drift back into obscurity after a series of flops |

16

There were many health IT

IPOs in 2020. What is your

prediction for the

enterprise value of the

following companies on

12/31/21? [Current market

cap 4/23/21]

| Oscar Health [$4.6B] | |

| 39% | Higher |

| 61% | Lower |

| Accolade [$2.9B] | |

| 58% | Higher |

| 42% | Lower |

| Clover Health [$3.6B] | |

| 30% | Higher |

| 70% | Lower |

| GoodRx [$15.5B] | |

| 45% | Higher |

| 55% | Lower |

| American Well [$4.5B] | |

| 41% | Higher |

| 59% | Lower |

| Hims & Hers Health [$2.1B] | |

| 41% | Higher |

| 59% | Lower |

| Oak Street Health [$14.6B] | |

| 42% | Higher |

| 58% | Lower |

17

Rank the following

potential 2021 IPOs based

on your excitement

about their long term

fundamentals:

| Privia Health | |||||

| Total 3.13 | |||||

| 21% | 1 | 23% | 2 | 20% | 3 |

| 21% | 4 | 15% | 5 | ||

| Bright Health | |||||

| Total 3.58 | |||||

| 33% | 1 | 26% | 2 | 15% | 3 |

| 17% | 4 | 9% | 5 | ||

| Agilon Health | |||||

| Total 3.03 | |||||

| 15% | 1 | 22% | 2 | 26% | 3 |

| 23% | 4 | 14% | 5 | ||

| VillageMD | |||||

| Total 3.19 | |||||

| 22% | 1 | 23% | 2 | 18% | 3 |

| 25% | 4 | 12% | 5 | ||

| Ro | |||||

| Total 2.11 | |||||

| 11% | 1 | 5% | 2 | 19% | 3 |

| 15% | 4 | 50% | 5 | ||

18

Tiger Global has burst onto

the health IT scene. Rank

their recent growth round

investments based on long

term success potential:

| Komodo Health | |||||

| Total 4.47 | |||||

| 23% | 1 | 16% | 2 | 17% | 3 |

| 11% | 4 | 10% | 5 | 11% | 6 |

| 12% | 7 | ||||

| Hinge Health | |||||

| Total 4.3 | |||||

| 12% | 1 | 16% | 2 | 19% | 3 |

| 21% | 4 | 13% | 5 | 13% | 6 |

| 6% | 7 | ||||

| Cityblock Health | |||||

| Total 4.39 | |||||

| 16% | 1 | 12% | 2 | 19% | 3 |

| 17% | 4 | 22% | 5 | 10% | 6 |

| 9% | 7 | ||||

| Virta Health | |||||

| Total 4.3 | |||||

| 13% | 1 | 19% | 2 | 17% | 3 |

| 20% | 4 | 9% | 5 | 13% | 6 |

| 9% | 7 | ||||

| Aledade | |||||

| Total 4.5 | |||||

| 24% | 1 | 18% | 2 | 9% | 3 |

| 11% | 4 | 20% | 5 | 9% | 6 |

| 9% | 7 | ||||

| Cedar | |||||

| Total 3.23 | |||||

| 8% | 1 | 11% | 2 | 9% | 3 |

| 10% | 4 | 14% | 5 | 26% | 6 |

| 22% | 7 | ||||

| DispatchHealth | |||||

| Total 3.33 | |||||

| 11% | 1 | 13% | 2 | 12% | 3 |

| 8% | 4 | 8% | 5 | 14% | 6 |

| 34% | 7 | ||||

19

What 2020/2021 growth

rounds would you have

invested in? (choose up

to 3)

| 19% | Komodo Health @ $3.3B |

| 18% | Hinge Health @ $3B |

| 36% | Cityblock Health @ >$1B |

| 29% | Virta Health @ $2B |

| 44% | Aledade @ $2.1B |

| 18% | Cedar @ $3.2B |

| 27% | DispatchHealth @ $1.7B |

| 17% | Ro @ $5B |

| 11% | Color @ $1.5B |

| 44% | Lyra Health @ $2.3B |

20

The end of Covid-19 could

result in steep reductions in

growth for certain health IT

segments that grew

significantly during the

pandemic. Which segments

will be affected? (select all

that apply)

| 54% | Telemedicine |

| 65% | Lab testing |

| 18% | Mental health |

| 18% | Virtual care for diabetes |

| 36% | Virtual care for musculoskeletal disease |

| 3% | Other |

21

Will the Biden

administration tackle high

drug prices?

| 6% | Yes, as a way to fund infrastructure spending |

| 19% | Yes, as a CMMI demonstration |

| 65% | No, they will try but not be able to get a bill through the Senate |

| 10% | No, public sentiment is pro-pharma thanks to Covid-19 vaccines and therapeutics |

22

Which are the largest

challenges to health IT

innovation in the next 12

months? (select all that

apply)

| 28% | Economic uncertainty |

| 12% | Funding |

| 36% | Regulatory changes |

| 54% | Talent/hiring |

| 39% | Competition |

| 39% | Recovery from Covid-19 |

23

Over the next two years,

the creation of new health

IT companies will…

| 31% | Increase significantly |

| 50% | Increase somewhat |

| 15% | Stay the same |

| 4% | Decrease |

24

My organization is making

a conscious effort to

ensure diversity at all

ranks. Our team is now...

| 18% | No more diverse than we were one year ago |

| 42% | A little bit more diverse than we were one year ago |

| 31% | Moderately more diverse than we were one year ago |

| 9% | Dramatically more diverse than we were one year ago |

25

Which category best

describes your employer?

| 19% | Health IT provider |

| 4% | Large employer |

| 7% | Insurance company |

| 10% | Healthcare provider |

| 3% | Academia |

| 1% | Government |

| 28% | Investor |

| 15% | Professional services |

| 13% | Other |